Medical equipment depreciation calculator

Enter the value of the gifts you have given during the selected tax year. HOME PROVIDERS DOCUMENTS NEWS CAREERS EVENTS TOOLS STORMWATCH TECHNOLOGY.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation on computers Dr.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

. Reduce your energy costs and benefit from a discount when financing the latest fuel and energy efficient vehicles and equipment. Subtract line 2 from line 1. Choose your filing status from the drop-down list.

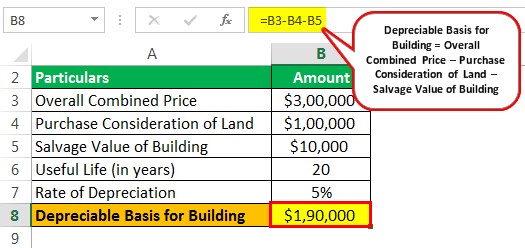

The primary goal of a Cost Segregation study is to identify all property-related costs that can be depreciated over 5 7 and 15 years. Enter your selling expenses. We guarantee that between price warranty and service the value you receive wont be beat.

The calculator should be used as a general guide only. Use our Tax Calculator software claim HRA check refund status and generate. Loan Repayment Examples Example 1.

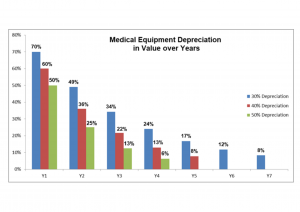

You may use the depreciation calculator to calculate the depreciation amount. How to use the gift tax calculator. HOME PROVIDERS DOCUMENTS NEWS CAREERS EVENTS TOOLS STORMWATCH TECHNOLOGY.

And our equipment is specifically designed to meet your companion animal or equine practice needs. These items have been filtered to our Appliances - Major category. DC Defibrillators for pacemakers and internal use.

The sum insured is considered to be the total cost of replacing the damaged or stolen equipment with other equipment of the same model and condition. Depreciation In auto insurance depreciation is used to determine the actual cash value of a vehicle in the event it is determined to be a total loss. As soon as the car comes out of the showroom its price drops down to almost half the amount you have bought it for.

Home office equipment and furniture. Undergraduate Student Loans Graduate Student Loans Parent Loans Refinancing for Students Refinancing for Medical Residents Refinancing for Parents Scholarship. If the monthly payment is known use the Fixed Pay tab to calculate the effective interest rate.

Employer credit for paid family and medical leave Form 8994. HRA Calculator Monthly Yearly Calculations. This tax depreciation method gives you a significant tax deduction in the earliest years.

Learning Lease or Buy Equipment Calculator Business Loan Calculator Working Capital Calculator. For an estimate of deductions you may be entitled to or to have your current depreciation schedule reviewed free of charge please dont hesitate to get in. You can use this gift tax calculator to determine the amount of tax you owe over a given taxation period.

Where to claim it. This is where a zero-depreciation add on cover comes into the picture. Our customer service and engineering expertise in digital x-ray equipment are unmatched.

Excess scheme fees credit Total contributions 4 x medical schemes credit. If you are in the business of renting personal property equipment vehicles formal wear etc. Schedule C Box 20 Rent or lease The home office deduction lets you write off part of your personal rent.

Enter the amount that the medical equipment or property sold for. These items have been filtered to our Furniture category. Now lets calculate the excess scheme fees by applying the formula for someone under 65 years old without a disability.

The Depreciation Calculator computes the value of an item based its age and replacement value. It is common knowledge that the depreciation value of any commodity be it electronics or a car starts its journey southwards as soon as you make a purchase. Like depreciation these are other non-cash charges to your net income that should.

CC C Inc. Enter the adjusted basis of the equipment or property from Worksheet D line 5 or line 12 if applicable. Factors such as miles driven model year and overall condition will be used to determine the current value of the car.

The calculator should be used as a general guide only. It helps protect your finances in case of a claim due to physical damages to your car. Once the sum insured is determined the premium is calculated.

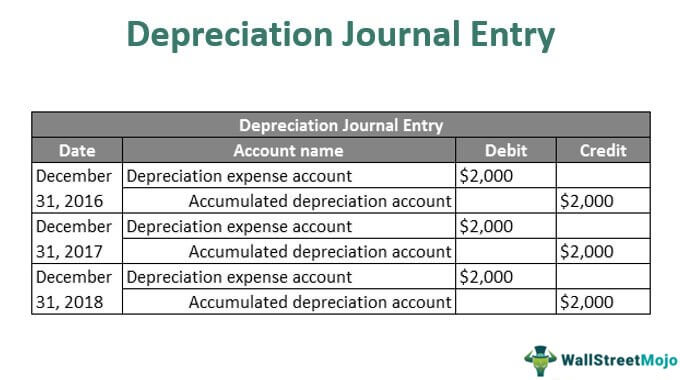

Below is the journal entry to record depreciation on office equipment. If the interest rate is known use the Fixed Rate tab to calculate the monthly payment. There are many variables which can affect an items.

Currently many categories of vehicles and equipment can qualify including yellow goods agri machinery electric and hybrid vehicles renewable energy projects charging equipment batteries and lighting. Has been running a business for the last 50 years and is a well-established market firm. Depreciation Calculator As Per Income Tax Act.

Life Saving medical equipment being-a DCDefibrillators for internal use and pace makersb Haemodialysorsc Heart lung machined Cobalt therapy unite Colour Dopplerf Spect Gamma. MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS. The Depreciation Calculator computes the value of an item based its age and replacement value.

This is the total gain or loss from. X-ray and electrotherapeutic apparatus and accessories thereto medical diagnostic equipments namely Cat-scan Ultrasound Machines ECG Monitors etc. If you take a section 179 deduction explained in chapter 8 under Depreciation for an asset and before the end of the assets recovery period the percentage of business use.

The equipment to be insured The age of the equipment The aggregate value of the electronic equipment. The Lease Calculator can be used to calculate the monthly payment or the effective interest rate on a lease. The directors have good relations with the bank they deal with and have created goodwill Created Goodwill In accounting goodwill is an intangible asset that is generated when one company purchases another company for a price that is.

These MACRS depreciation methods include. If you own an investment property the best way to ensure your depreciation deductions have been maximised is to use a depreciation schedule prepared by Capital Claims Tax Depreciation. Good for lowering.

Select your tax year. Life Saving medical equipment. Subtract line 4 from line 3.

In order to maintain the monetary value of your vehicle you are suggested to opt for the zero depreciation add-on to get the best coverage amount after the depreciation. Depreciation Calculator Companies Act 2013. The 200 or double-declining depreciation simply means that the.

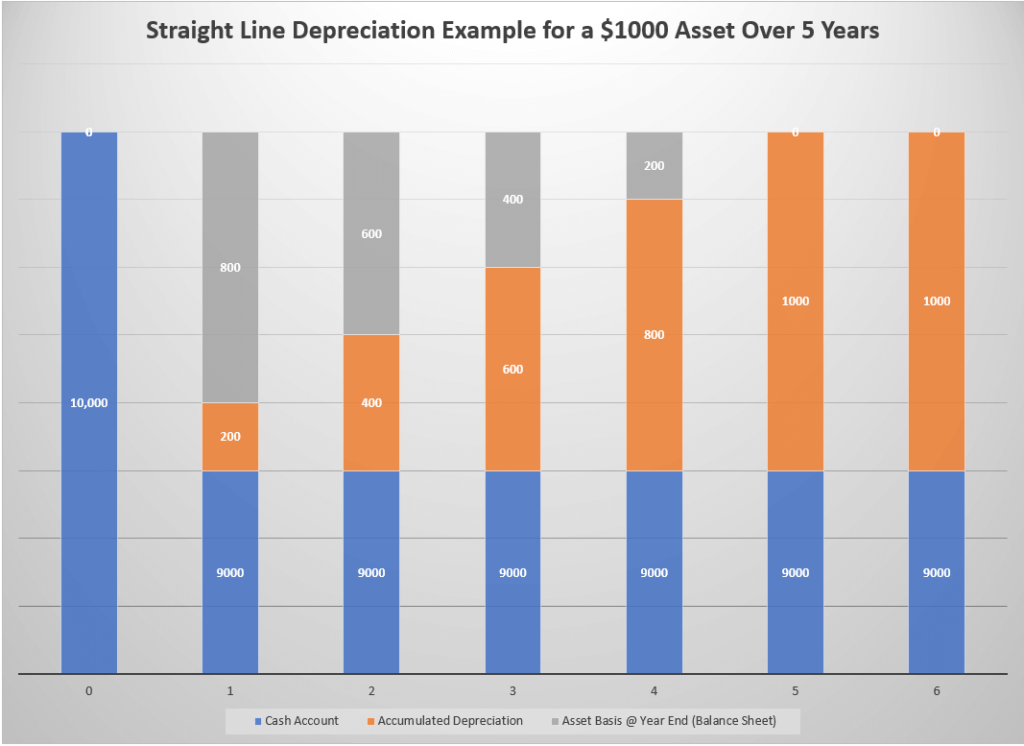

GDS using 200 declining balance. For example certain electrical outlets that are dedicated to equipment such as appliances or computers should be depreciated over 5 years. Depreciation under Income Tax Act is the decline in the real value of a tangible asset because of consumption wear and tear or obsolescence.

Annual medical scheme fees credit Monthly credits x 12 R 347 x 2 R 234 x 2 x 12 R 694 R 468 x 12 R 1 168 x 12 R 13 944. There are many variables which can affect an items life. If youre a freelancer who rents a separate office or coworking space thats a.

What Is Equipment Depreciation And How To Calculate It

Depreciation Of Building Definition Examples How To Calculate

How To Calculate Depreciation Expense For Business

How To Calculate Book Value 13 Steps With Pictures Wikihow

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Straight Line Depreciation Accountingcoach

Yearly Comparison Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Balance Sheet Reconciliation

Used Medical Equipment Valuation How Much Should You Pay

What Is Equipment Depreciation And How To Calculate It

Amp Pinterest In Action Chart Of Accounts Business Tax Deductions Accounting

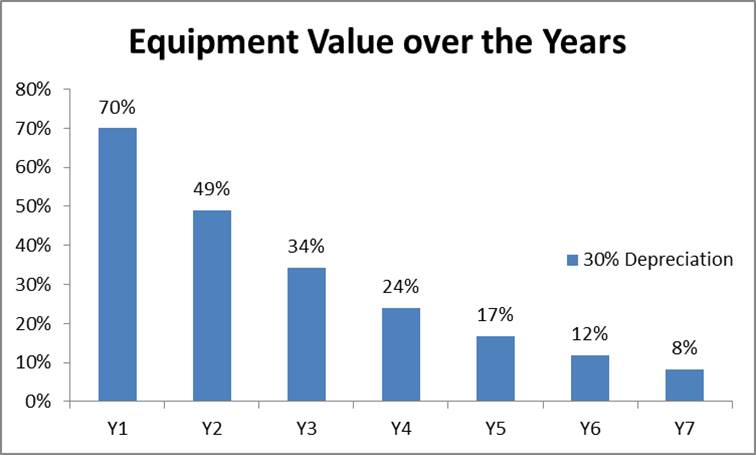

Medical Equipment Value At 30 Depreciation Rate Primedeq Blog

Depreciation Journal Entry Step By Step Examples

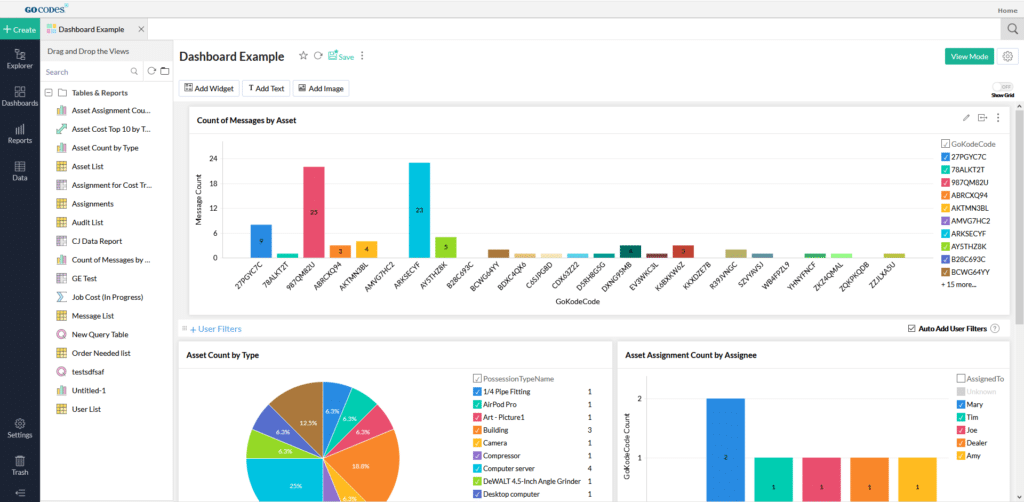

What Is Equipment Depreciation And How To Calculate It

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Overview How It Works Example

Free Professional Balance Sheet Templates In Excel Balance Sheet Template Balance Sheet Excel